1. FINANCIAL MANAGEMENT AND POLICIES OF THE CENTRAL BANK OF CHILE IN 2016

(*) Mario Marcel has served as Governor since 11 December 2016. Rodrigo Vergara was Governor through 10 December 2016.

Annual inflation fell in 2016, returning to the target range around mid-year and ending the year at around 3%. Thus, annual inflation started the year at 4.8% in January and declined to 2.7% in December.

The monetary policy rate (MPR) was 3.5% throughout 2016, after reaching that level in December 2015 in response to the greater risks for the convergence of inflation to 3% in the latter part of that year.

Since September 1999, the Central Bank of Chile has applied a floating exchange rate regime, in which the exchange rate is determined by the market.

In August 2016, the Board authorized Corredores de Bolsa SURA S.A. to participate in the Formal Exchange Market (FEM).

To support the implementation of monetary policy, the Bank monitors market liquidity and employs the mechanisms and instruments at its disposal to ensure that the interbank interest rate remains around the monetary policy rate (MPR).

In 2016, the Central Bank completed its regular macroeconomic statistics revision and publication schedule: National Accounts, Balance of Payments and International Investment Position, Monetary and Financial Statistics, and Foreign Exchange Statistics.

In 2016, the Treasury Management continued to fulfill its mandate to oversee cash cycle management so as to ensure the normal functioning of the payment systems, in particular with regard to cash money in circulation in the country.

The behavior of the economy and the policies adopted by the Central Bank of Chile affect the size and composition of the Bank’s balance sheet, which in turn affects the trend in earnings and losses. Thus, the debt in the form of Central Bank promissory notes on the liability side is largely explained by the need to finance the rescue of the financial system following the crisis in the first half of the 1980s and by the need to sterilize the monetary effects of the accumulation of international reserves in the 1990s and, more recently, in 2008 and 2011.

The National Commission on Price Distortions is in charge of investigating the existence of price distortions on imported goods. It is a technical body composed of representatives from public institutions in the economic sector.

The Board has five members, one of whom acts as chair and also serves as the Central Bank’s Governor. The Board is responsible for the senior governance and management of the Bank, in its quality as an autonomous, technical public institution with constitutional authority.

The Central Bank of Chile’s vision is to be widely recognized as a leading, autonomous, technical institution, known for its institutional values and the effectiveness with which it achieves price stability and the normal functioning of the payment system.

These management-related expenses include personnel compensation and benefits; the use and consumption of goods and services; and other expenses necessary for carrying out the Bank’s activities (table 2.3).

The main objectives of the Central Bank’s publication program are to increase transparency in the delivery and communication of economic information, improve its timeline, and provide the public with information on key economic issues.

The process of replacing the server storage racks at the main processing site with an earthquakeresistant design, which began in 2015, continued in 2016, thereby improving resilience to seismic events.

At its monthly monetary policy meeting, the Board of the Central Bank of Chile decided to hold the monetary policy interest rate at 3.5%.

Internationally, the increase in the U.S. Federal Reserve’s interest rate has not caused significant changes in the global financial markets.

The Board of the Central Bank of Chile approved the annual auction calendar for 2016. The program considers scheduled debt maturities for an amount equivalent to Ch$2.860 trillion, of which Ch$1.400 trillion would be absorbed through Central Bank discount promissory notes (PDBC) and Ch$800 billion would be rolled over as peso-denominated Central Bank bonds (BCP) maturing in 2019.

The Bank reported that the Board, in its regular session on 17 December 2015, approved the annual schedule for the placement of debt instruments in 2016 (the Debt Plan). The program considers scheduled debt maturities for an amount equivalent to Ch$2.860 trillion, of which Ch$1.400 trillion would be absorbed through Central Bank discount promissory notes (PDBC) and Ch$800 billion would be rolled over as peso-denominated Central Bank bonds (BCP) maturing in 2019.

International reserves are liquid foreign currency assets held by the Central Bank of Chile to support its monetary and foreign exchange policies. They are one of the instruments available to the Bank to meet its permanent objective of safeguarding the stability of the currency and the normal operation of the internal and external payment systems.

The management of these reserves aims to guarantee secure, efficient access to international liquidity and to safeguard the financial equity of the Bank. To achieve this, the Bank acts according to the legal framework stipulated in Section 38 of its Basic Constitutional Act, which specifically grants it the authority to manage, maintain, and use its international reserves abroad.

As Fiscal Agent, the Central Bank of Chile manages resources in the name and on the account of the General Treasury. These resources are part of the Economic and Social Stabilization Fund (ESSF) and the Pension Reserve Fund (PRF).

Banco Central de Chile was formed on August 22, 1925, by Decree Law 486. Central Bank of Chile is a constitutionally autonomous entity, has full legal capacity, its own assets and has indefinite duration, created in accordance with Articles 108 and 109 of the Political Constitution of Chile and ruled by its Basic Constitutional Act.

The Governor and Board Members of Banco Central de Chile:

Report on the financial statements

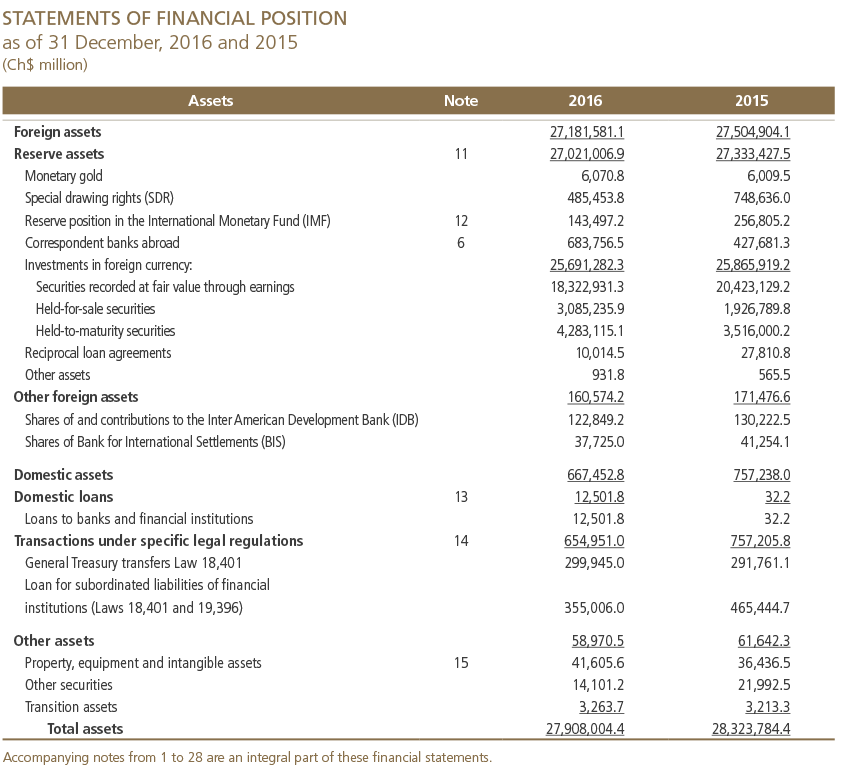

We have audited the accompanying financial statements of Banco Central de Chile, which comprise the statements of financial position as of 31 December 2016 and 2015, and the related statements of comprehensive income, changes in equity, and cash flows for the years then ended, and the related notes to the financial statements.

Agustinas 1180, Santiago, Chile

Casilla postal 967, Santiago, Chile

Casilla postal 834-0454, Santiago

Tel: 56-2-2670 2000

www.bcentral.cl | bcch@bcentral.cl